Pin Up Casino

Pin Up Casino: Unveiling the Thrills of Pin-Up Entertainment

In the realm of virtual gaming, Pin Up Casino emerges as a true powerhouse, captivating audiences with its exceptional variety and exhilarating experiences. A one-stop hub for gaming enthusiasts, Pin Up Casino boasts an extensive repertoire of gaming selections and innovative features, making it a sought-after destination for both novices and experts alike.

The Diverse Pin Up Casino Gaming Collection:

The allure of Pin Up Casino lies in its expansive array of gaming options, catering to an eclectic range of preferences. From classic table games, including poker, roulette, and blackjack, to an assorted assortment of cutting-edge slot machines, players can relish a rich diversity of options tailored to suit their individual tastes. Whether you're a connoisseur of traditional casino pursuits or an aficionado of modern video slots, Pin Up Casino ensures an immersive encounter for all.

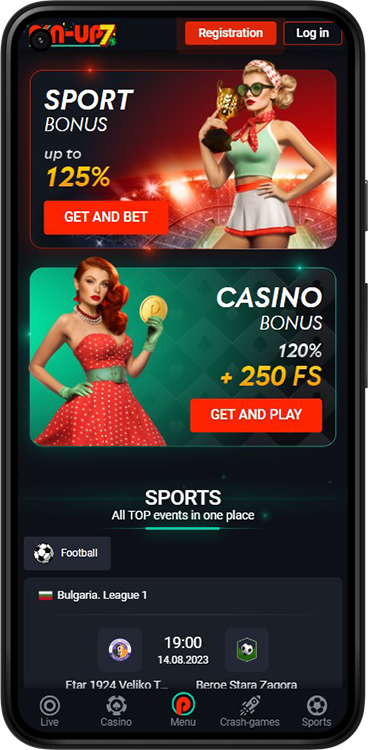

User-Friendly Interface at Pin-Up Casino:

Central to the Pin Up Casino experience is its remarkably intuitive user interface, meticulously designed to augment overall gameplay enjoyment. Seamlessly navigating through the platform, players can swiftly access their favored games, effortlessly manage their accounts, and seamlessly delve into ongoing promotional offerings. The interface's streamlined design and unparalleled responsiveness ensure uninterrupted gameplay across diverse devices, spanning desktops, tablets, and smartphones.

Promotions and Bonuses at Pin Up Casino:

Elevating player gratification, Pin Up Casino boasts an impressive spectrum of promotional initiatives and bonus provisions. From the enticing allure of welcome bonuses to the excitement of free spins and loyalty rewards, Pin Up Casino consistently entices new players while securing enduring benefits for its dedicated patrons. These incentives not only enhance the thrill of gameplay but also amplify the potential for substantial wins.

Security and Fair Play at Pin-Up Casino:

Security stands as a cornerstone of the Pin Up Casino ethos. The platform employs state-of-the-art encryption mechanisms to safeguard sensitive player data, ensuring privacy and confidentiality. Moreover, stringent auditing procedures are in place to guarantee equitable gameplay and unbiased outcomes, fostering an atmosphere of trustworthiness that players can rely on.

A Plethora of Payment Methods:

Pin Up Casino prides itself on providing an extensive selection of secure and expedient payment avenues, facilitating both deposits and withdrawals. Players can take advantage of a versatile range of options, spanning credit and debit cards, electronic wallets, and bank transfers, thereby streamlining financial transactions for maximum convenience.

Customer Support Excellence:

A testament to its commitment to player satisfaction, Pin Up Casino excels in providing unwavering customer support services. Accessible through multiple channels, including live chat, email correspondence, and an exhaustive FAQ section, the dedicated support team promptly addresses player queries, concerns, and technical issues.

Concluding Thoughts on Pin Up Casino:

In a fiercely competitive domain, Pin Up Casino emerges as an unparalleled beacon of immersive entertainment, marked by its expansive game offerings, user-friendly design, and unwavering commitment to player security. The fusion of exhilarating gameplay and an environment of trustworthiness solidifies Pin Up Casino's status as the ultimate platform for gaming enthusiasts seeking a blend of excitement and substantial rewards.

If you've decided to give Pin-Up Casino a try, you can expect a wide variety of slots, table games, and live dealer games. Playing at Pin-Up Casino is possible wherever the casino operates officially. Visit Pin-Up Casino in Brasil, Pin Up Casino in México, Pin-Up Casino in Turkey, and Pin Up Casino in Chile to learn about the availability of the casino in your country

Download Pin-Up Casino

Download Pin-up Casino using our link. Everyone can access the download of Pin-up and install the mobile casino application on their Android device. We also provide instructions on how to use the program for free after downloading.

The mobile application, Pin-up Casino for Android, is available for download in apk format. Since the Pin Up app for Android is not present in the official Google Play store, it can be downloaded from the official website provided. Before downloading, it is recommended to enable the installation of programs from unknown sources in the device settings; otherwise, the apk file will be blocked.

After clicking on the link with the .apk extension, a context menu will appear where you should select "Install on Android." Continue by pressing "Download on Android." When a warning window appears about potential risks, press "OK" and save.

The installation of Pin-up Casino on Android is carried out automatically after downloading the file. Ensure that all necessary permissions are enabled in the device settings for a successful installation. Follow the instructions:

- Open Settings;

- Go to the "Apps" or "Settings" section (depending on the Android version);

- Open the "Security" and "Device Administration" tabs;

- Check the box next to "Unknown sources" (in other versions, you may need to click on "Special access rights");

- Confirm your selection.

- Proper execution of these steps will ensure the automatic installation of the Pin-Up app, taking approximately one minute.